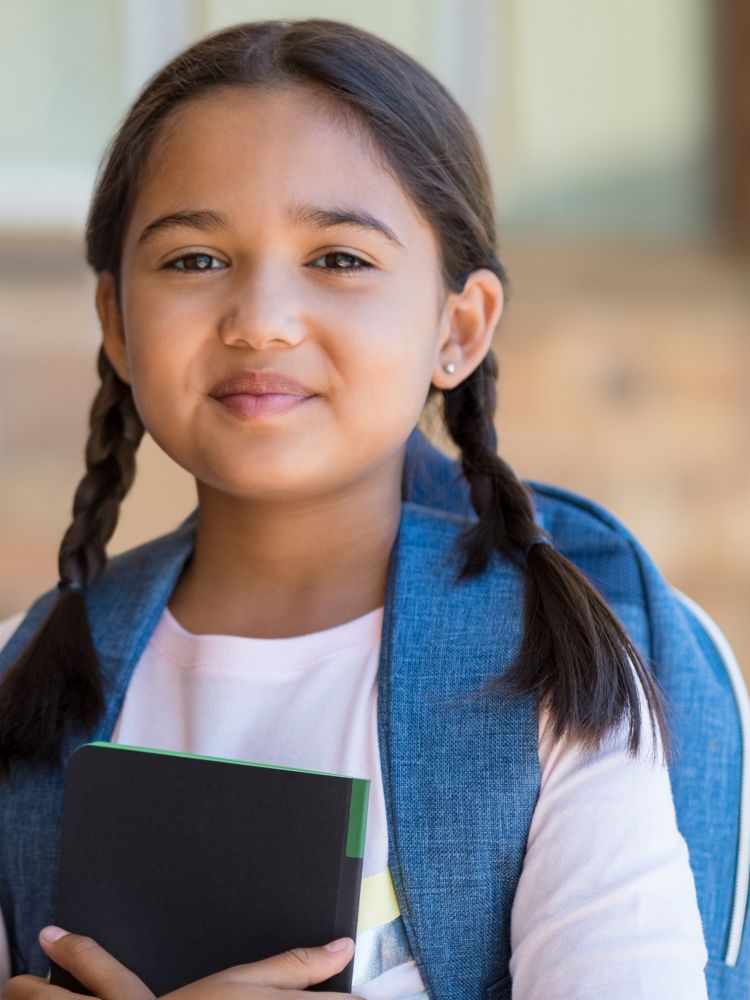

Youth Accounts

Youth Savings Account

Teach your child good financial habits from the start. A Youth Savings account can help establish healthy money management habits and is a wonderful way to invest in your children’s future.

Youth Savings Account

Teach your child good financial habits from the start. A Youth Savings account can help establish healthy money management habits and is a wonderful way to invest in your children’s future.

Benefits of opening a Youth Savings Account

- Establishes smart money management habits

- Installs financial responsibilities

- Creates smart spending techniques

- Encourages goal setting

About our Youth Savings account

- Available to members between the ages 0-17

- It is a free savings account in the name of a child with a parent or guardian as the joint owner

- Pays a high interest rate on the first $500

Product Features

- One-time opening deposit of $5 to maintain membership

- High rate of interest is earned on balances $5-$500. Balances above the $500 will earn the standard rate of interest for a Primary Savings Account

- At age 18, the account will switch to a Primary Savings Account

- Dividends compound and pay monthly

- Access to Online and Mobile Banking

- Access to Love My Credit Union Rewards

Teen Checking Account

Our Youth Checking Account helps establish healthy money management skills with a free debit card.

Available for ages 13-17

Why open a checking account for your child?

There are many benefits of a checking account for your child, checking accounts teaches children the value of money management by providing a hands-on experience. It’s a great tool for parents to manage allowances and for children kickstarting their financial earnings with summer jobs and internships.

Benefits of opening a checking account:

- Establishes a financial path, allowing both children and parents to monitor spending habits so they can visibly see their money grow and shrink. This teaches children about healthy spending and financial planning

- Creating a checking account can help children understand the differences between spending and saving. Helping them better prepare for real world expenses in the future

- A River City FCU Youth Checking account provides access to online & mobile banking, allowing your child to keep tracking of their financial spending in real time, wherever they go

About our Teen Checking Accounts:

- Available to members between the ages of 13-17

- Must provide a valid photo ID (Passport, Driver License, Military ID or student ID)

- Must provid Social Security Card or Certified copy of birth certificate

- Proof of mailing/ physical address of the primary account holder

- Valid email and phone number

Product Features

- Fee free checking account with no hassle

- Parents have the option to monitor to their child’s checking account

- Access to Online and Mobile Banking

- Access to Love My Credit Union Rewards