TITLE LOAN

GET THE MONEY YOU NEED THE SAME DAY.

A title loan with River City FCU, can help you in your time of need with a low, competitive fixed rate and manageable repayment. It is a safe alternative to predatory title lenders.

A title loan is a secured loan that uses your vehicle as collateral. It is a good option to look at when you’re in need of extra funds and own a vehicle.

About our Title Loan:

Fixed rate of 18% APR*

Terms from 12 to 48 months available

Minimum loan amount of $500

Maximum loan amount of $10,000

No hidden fees

Requirements**

Maximum vehicle age is 12 years

Car insurance may be required*

Traditional vehicles only (no motorcyles, ATVs, etc.)

Applicant must be listed as owner in the car title

Registration must be current and cannot expire in the next 60 days

Visual inspection of collateral may be required

*APR means Annual Percentage Rate as of December 1, 2023, and is subject to change without prior notice. Auto Insurance requirement varies per loan amount. ** Additional requirements might apply.

ABOUT CAR TITLE LOANS

A car title loan is a short-term loan that uses a vehicle as collateral. To obtain a title loan, the borrower must own their car free and clear - if the borrower fails to repay the loan, the lender then takes ownership of the car.

You’ve probably heard of lenders like TitleMax, EZ Title Loans, Texas Title Loans, and many more, offering quick and easy cash. While yes, it is true they can offer immediate solutions with no credit checks, they are also known as predatory lenders. They will lend you the money but this usually leads to a circle of debt due to unmanageable payments.

A predatory loan is any loan that has predatory terms such as:

High interest rates

Short payment terms

Balloon payments (one large payment due at the end of payment term)

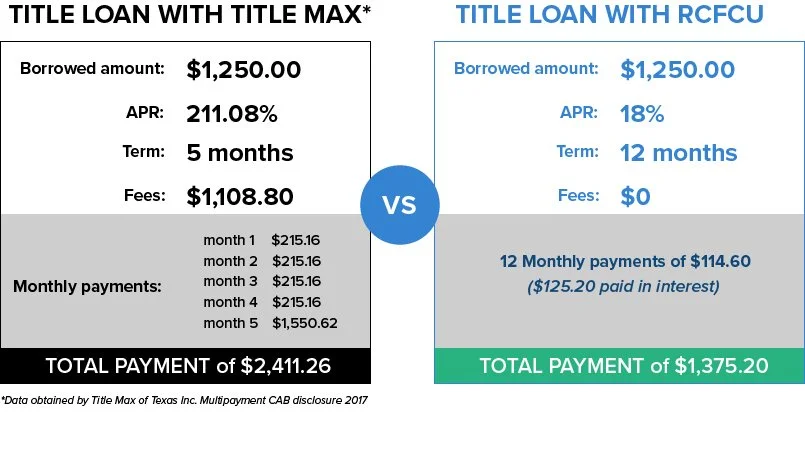

Below is an example comparing a Title Loan of $1,200 through Title Max* versus River City FCU